Gambling winnings are fully taxable by the Commonwealth of Pennsylvania. State residents must pay state income tax on all gambling and lottery winnings from any source, except for non-cash prizes from playing the Pennsylvania State Lottery. As a resident, you must include lottery winnings from other states and countries.

- Taxes On Gambling Winnings In Pa

- Pa Tax Gambling Winnings

- Gambling Winnings Tax Pa

- California Tax On Gambling Winnings

The new Pennsylvania gambling expansion law passed largely because the state desperately needed a new source of tax revenue. One of the biggest sources of that revenue will be the upfront licensing fees for all the new types of gambling.

Even with the potential for big returns, the first state budget after expansion only expected $100 million from online gambling. That is a figure Pennsylvania surpassed after the first mini-casino auction.

Thanks to other elements of the new law, it is already raking in money. How much so far?

Last updated: Dec. 17, 2019

How does that number break down? Let’s look at how much each category brought in:

Sports betting revenue starts rolling in

The first month of sports betting revenue was not exactly awe-inspiring. With only one property open for less than two weeks, the first month of total revenue came to just over $500,000. Of that, $173,000 went back to the state and $10,000 or so to local communities.

Now that online sports betting is underway, the state is breaking handle records every month. Online betting is already more popular than retail betting, which means the revenue, and the state’s tax revenue will continue to rise.

Here is a look at the tax revenue from sports betting so far:

November 2019: $5,299,449

October 2019: $5,381,370

September 2019: $5,062,216

August 2019: $2,201,406

July 2019: $1,026,769

June 2019: $979,302

May 2019: $1,030,267

April 2019: $1,519,733

March 2019: $1,986,962

February 2019: $700,853.95

January 2019: $938,597.00

December 2018: $722,356.00

November 2018: $183,238.77

Online casino taxes now a PA revenue stream

With the launch of online casino sites, the state got another tax revenue stream. This one will eventually offer quite a bigger chunk than sports betting. With online slots raking 54% in taxes on revenue, that means the state gets even more than the site when it comes to profit.

Table games provide a good chunk as well, with a 16% taxation rate.

Here is a look at each months slot and table games breakdown:

November 2019

Slot tax: $2,750,645

Table games tax: $415,445

Total online casino tax: $3,166,090

Taxes On Gambling Winnings In Pa

October 2019

Slot tax: $2,147,692

Table games tax: $154,517

Total online casino tax: $2,302,209

September 2019

Slot tax: $1,746,962

Table games tax:$144,039

Total online casino tax: $1,891,001

August 2019

Slot tax: $1,643,397

Table games tax: $191,601

Total online casino tax: $1,835,058

July 2019

Slot tax: $279,564

Table games tax: $47,135

Total online casino tax: $326,700

Mini-casino auction profits

| Parent Casino | Bid Amount | Location | Additional table games license? |

|---|---|---|---|

| Hollywood Casino | $50,100,000 | Yoe in York County | N/A |

| Stadium Casino LLC | $40,100,005 | Derry in Westmoreland County | Yes |

| Mount Airy Casino | $21,888,888.88 | New Castle in Lawrence County | N/A |

| Parx Casino | $8,111,000 | South Newton in Cumberland County | N/A |

| Hollywood Casino | $7,500,003 | West Cocalico Township in Lancaster County | N/A |

VGT tax revenue

November 2019: $342,830

October 2019: $242,522

August/September 2019: $168,849

Lottery expansion nears $45 million in revenue

PA Lottery was part of the gambling expansion bill as well. The laws allowed for the introduction of three new elements of lottery offerings. Those are:

- Virtual sports

Keno rolled out May 1, 2018, followed by online lottery games on May 22. Xpress Sports, the virtual sports element, went live in August.

Based on numbers provided by the PA Lottery in its annual fiscal reports, profits from each of the following game types since launch are as follows:

Online lottery: $32.96 million

Keno and virtuals: $11.62 million

Daily fantasy sports revenue

While daily fantasy sports (DFS) was not explicitly illegal in Pennsylvania, the 2017 gambling expansion regulated the industry. With that regulation comes taxation and licensing fees.

Ten fantasy sports operators needed to each pay a $50,000 licensing fee. Their revenue is taxed at a rate of 15 percent. Here is a look at each month’s tax revenue from DFS as well as the total amount of tax revenue to date:

- May 2018: $199,755.94

- June 2018: $152,679.34

- July 2018: $131,727.75

- August 2018: $141,543.03

- September 2018: $320,057.10

- October 2018: $435,429.45

- November 2018: $486,174.15

- December 2018: $429,075.51

- January 2019: $317,475

- February 2019: $244,376.75

- March 2019: $245,226.70

- April 2019: $277,883

- May 2019: $270,458

- June 2019: $238,847

- July 2019: $186,730

- August 2019: $208,295

- September 2019: $439,357

- October 2019: $489,654

- November 2019: $447,174

Lady Luck Nemacolin lone sports betting holdout

In August 2018 Pennsylvania finally got its first official sports betting applicant. Penn Nationalfiled its petition, breaking the weeks of inactivity that had many worrying that nobody would bite.

As of December 2019, 12 of the 13 eligible casinos have submitted applications for the $10 million license. The lone holdout is Lady Luck Nemacolin.

Interactive gaming petitions generate $94 million

The 90-day window for PA casinos to apply for $10 million comprehensive interactive gaming petitions opened in mid-May. For the first 85 days, there was no news — a panic set in that there might be few or no applicants.

In the end, though, a majority of the 13 casinos ponied up the fee, which allows them to offer online peer-to-peer games like poker, online slots, and online table games. The seven casinos who filed for petitions and received approval are:

Once the all-in-one license application period ended, PA casinos could still purchase a la ca carte licenses for each of the three categories. Presque Isle Downs owner Churchill Downs spent $8 million applying for online poker and online slots. In an unusual move, Mohegan Sun Pocono paid a $2 million premium to apply for all three licenses for $12 million.

On Oct. 4, Rivers surprisingly rescinded its interactive application. Rush Street Gaming owns both Rivers and SugarHouse, so presumably, Rivers will support that interactive offering instead of launching a separate one. That opens up three more licenses, bringing the total to 10.

On Oct. 31, Stadium Casino rescinded its peer-to-peer application but retained its online slots and table games licenses so that it will pay $8 million in licensing fees.

A third casino rescinded its peer-to-peer application Nov. 28. Mohegan Sun Pocono informed PGCB that it would not seek to offer online poker either, so it too will pay $8 million.

The Meadows and Lady Luck Nemacolin opted not to apply for any interactive gaming licenses. The Meadows is owned by Penn National, who already applied for a comprehensive license. Lady Luck Nemacolin is managed by Churchill Downs now, and will likely defer to Presque Isle on the online gaming front.

Where does that leave these leftover licenses? Well, the law states the next step is to open up the applications to entities outside of Pennsylvania. The two applicants in that category are MGM Resorts and Golden Nugget Atlantic City.

Law generates $51 million for PA in a matter of hours

In 2017, the state received two payments in the days immediately following the passage of the law. One was a $1 million payment from Valley Forge Casino to remove the amenity fee requirement on the Category 3 property. The other was a $50 million payment by Stadium Casino LLC for its Category 2 casino license. The group is in the process of building a casino in the Stadium Park area of Philadelphia.

In June of 2018, the Stadium Casino project paid the state an additional $24,750,000 for the right to offer table games at the property when it opens, bringing the total licensing brought in from the group to $74.75 million.

Other sources of revenue from the law include:

On Oct. 31, Valley Forge also took advantage of another change in the law. For $2.5 million, the resort casinos could up the number of slot machines on property. After a year of gaming revenue growth, the casino decided it was time to expand.

After nearly a year and a half of the law being in effect, Lady Luck Nemacolin elected to pay the $1 million to eliminate its $10 Category 3 amenity fee, leaving the state with no more casinos charging for entry.

After the thrill of collecting gambling winnings, comes questions about taxes.

Yes, gambling income, which includes winnings from slots, table games, horse racing, sports betting, lottery games, jackpots, and the like, is considered taxable income. As such, you are required to report them on your tax return. The car, boat, or Harley Davidson and other noncash prizes also need to be reported.

There are plenty of questions surrounding Pennsylvania taxes and gambling winnings. Now there are even more with the advent of sports betting, betting apps, and online casinos in Pennsylvania.

Here are some answers.

How much are my gambling winnings taxed?

Casinos withhold 25% of winnings for people who provide a Social Security number. If you do not provide your Social Security number the, the payer may withhold 28%.

Currently, Pennsylvania’s personal income tax is set at a rate of 3.07% against taxable money, which includes gambling and lottery winnings.

The new regular withholding rate

Effective for taxable years beginning after December 31, 2017, the withholding rate under Section 3402(q) applicable to winnings of $5,000 or more from sweepstakes, wagering pools, certain parimutuel pools, jai alai, and lotteries (formerly 25%) is 24%.

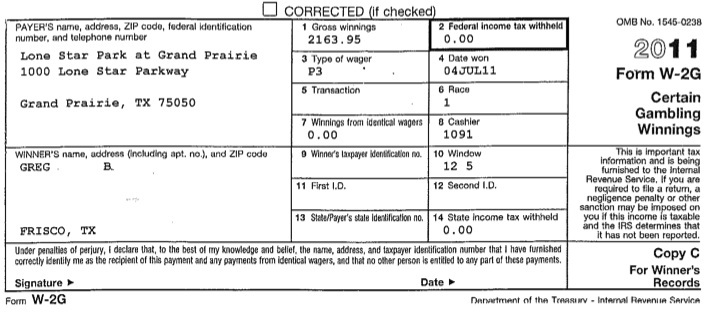

Federal Form W-2G, Certain Gambling Winnings

The organization that pays the winnings, in most cases, the casino, is responsible for sending the recipient of the winnings Form W-2G, Certain Gambling Winnings.

Form W-2G reports the number of winnings to you as well as the IRS.

The payer is required to send Form W2G only if the winner reaches the following thresholds:

- The winnings (not reduced by the wager) are $1,200 or more from a bingo game or slot machine

- The winnings (reduced by the wager) are $1,500 or more from a keno game

- The winnings (reduced by the wager or buy-in) are more than $5,000 from a poker tournament

- The winnings (except winnings from bingo, slot machines, keno, and poker tournaments) reduced, at the option of the payer, by the wager are:

- $600 or more, and

- At least 300 times the amount of the wager

- The winnings are subject to federal income tax withholding (either regular gambling withholding or backup withholding).

How to report PA gambling winnings on taxes

According to the IRS, you must report the full amount of your gambling winnings each year on Form 1040, U.S. Individual Income Tax Return, line 21.

You may receive a Form W-2G showing the amount of your gambling winnings and any tax withheld. Include the amount from box 1 on Form 1040, line 21. Include the amount shown in box 2 on Form 1040, on the line designated as federal income tax withheld.

What if I don’t receive a Form W2-G?

If you did not receive Form W-2G, your winnings are still considered taxable income. A payer is required to issue you a Form W-2Gi f you receive certain gambling winnings or have any gambling winnings subject to federal income tax withholding. You must report all gambling winnings as “Other Income” on Form 1040, Schedule 1 (PDF) and attach this to Form 1040, including winnings that aren’t reported on a Form W-2G.

Michelle Malloy, Esq. at AUA Capital Management, LLC in Conshohocken, Pennsylvania, commented:

“You are required to report all gambling winnings for federal and Pennsylvania taxes. If you hit a certain threshold they (the casino) will withhold money. In the instance where a casino doesn’t do their job and and fails to send you a W2-G you are still required to report your winnings, or you run the risk of underreporting your taxable income for the year.”

Do I have to pay taxes if a group of people win the lottery?

What happens when a group of coworkers chip in on a lottery ticket that wins? What about you and a friend who put money on a long-shot team to win the championship?

Meet Form 5754. Payers use this form to prepare Form W-2 G when the person receiving gambling winnings subject to reporting or withholding is not the actual winner or is a member of a group of two or more people sharing the winnings.

Don’t send Form 5754 to the IRS. Keep a copy for your records and return the form to the payer (usually the casino) for preparation of Form W-2G for each person listed as winners.

Pennsylvania state taxes for gambling

In addition to federal taxes payable to the IRS, Pennsylvania levies a 3.07 % tax on gambling income.

You should report your Pennsylvania taxable winnings on PA Schedule T and on Line 8 “Gambling and Lottery Winnings” of your PA-40 Personal Income Tax Return.

If your gambling winnings come during a trip to another state or country, you are still required to report.

“Pennsylvania takes the position that they are entitled to tax a portion of your worldwide income based on certain income items (wages, interests, dividends, capital gains, gambling winnings, lottery winnings, etc),” said Malloy.

Pa Tax Gambling Winnings

Are there any deductions available for taxes related to gambling?

Gambling losses can be deducted. However, they must be itemized on line 28 of Schedule A, Form 1040.

Also, you cannot deduct more than your winnings.

Expenses related to any gambling or lottery activities, (like your dinner at the steakhouse, celebratory drinks from the bar, or cost of hotel room) cannot be deducted.

If you are going to deduct gambling losses, keep these records:

- The date and type of each wager

- The name and location of the bet

- The amount won or lost

- Wagering tickets

- Canceled checks

- Credit card records

When using a players club/members card, casinos can track players’ spend. Therefore, you can request a win/loss report that will give you a fairly good sense of your activity in a casino. Online casino players can request the same report and most sites should be able to provide it without issue.

“A lot of people may under-report,” explained Malloy. “They might win $10,000 but have $3,000 of expenses so they think they are just going to report $7,000. That can be an issue, as Pennsylvania does not allow a deduction for expenses. If you win a lot of money in June, for example, you might want to make an estimated tax payment [due Sept. 15 and Jan. 15] so you don’t have an underpayment penalty the following April.”

How to claim gambling winnings and/or losses

Pennsylvania provides a helpful resource to determine how to claim gambling winnings and/or losses.

There is a prompt where you can start a ten-minute interview.

Be sure to have the following information ready:

- Your and your spouse’s filing status

- Amount of your gambling winnings and losses

- Any information provided to you on a Form W-2G

Taxes on multistate lotteries

The Pennsylvania Department of Revenue considers multi-state lottery prizes, like those from Powerball and Mega Millions, awarded on tickets purchased through a licensed Pennsylvania state lottery ticket vendor, a prize by the Pennsylvania Lottery.

“ Such prizes are considered Pennsylvania source income and both residents and nonresidents are subject to tax on such income if the prize is a cash prize. Multistate lottery prizes awarded on tickets purchased through a vendor in another state lottery are considered prizes awarded by that state lottery. Such prizes are not considered Pennsylvania source income and only residents are taxed on such income regardless of whether the prize is a cash or noncash prize.”

Due to a 2016 law change, any cash prize won from a Powerball of Mega Millions ticket in any state is taxable for state purposes, in addition to federal taxes.

What happens if you win a few thousand dollars on a winning PA lottery ticket?

Lottery winnings are included in taxable income. Pennsylvania Lottery winners of an individual prize valued at more than $600 will receive a Form W2-G by mail.

If your spouse also wins, they must report their winnings separately.

“For a significant windfall, like over $5 million, it definitely makes sense to talk to an attorney or accountant to determine if they should take a lump sum payout or annuity. They may also need to think about estate tax planning, financial planning and/or asset protection planning for their windfall,” said Malloy.

Gambling Winnings Tax Pa

Sports betting winnings and taxes

Sports betting winnings are taxable income.

The IRS states:

“Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips.”

Even though sports betting isn’t specifically listed, it falls under the umbrella of “gambling winnings.”

Wherever your sports betting win occurred – at the OTB, the casino, on a sports betting app – they payer should send Form W-2G.

Sports betting losses might also be used as deductions if you itemize your deductions and keep a detailed record of wins and losses.

Based on your tax bracket, sports bettors in Pennsylvania could owe up to 35 % of winnings to the federal government in addition to the 3.07 % Pennsylvania taxes net gambling winnings.

Online gambling and taxes

Sports betting apps and online casinos provide unmatched convenience. You may also enjoy the anonymity of playing behind a screen name instead of in person. However, it still comes with the same tax responsibilities. Online gambling winnings are considered taxable income at the same rate as other gambling winnings.

For online gambling winnings, the payer is required to send Form W2G only if the winner reaches the following thresholds:

- The winnings (not reduced by the wager) are $1,200 or more from a bingo game or slot machine

- The winnings (reduced by the wager) are $1,500 or more from a keno game

- The winnings (reduced by the wager or buy-in) are more than $5,000 from a poker tournament

- The winnings (except winnings from bingo, slot machines, keno, and poker tournaments) reduced, at the option of the payer, by the wager are:

- $600 or more, and

- At least 300 times the amount of the wager

- The winnings are subject to federal income tax withholding (either regular gambling withholding or backup withholding).

California Tax On Gambling Winnings

In terms of deductions for taxes, players can request a report from online casinos detailing wins and losses.

Comments are closed.